AMD Reports Q1 FY 2016 Results: Lower Revenue But New IP Licensing Agreement Reached

by Brett Howse on April 21, 2016 10:15 PM EST- Posted in

- CPUs

- AMD

- Financial Results

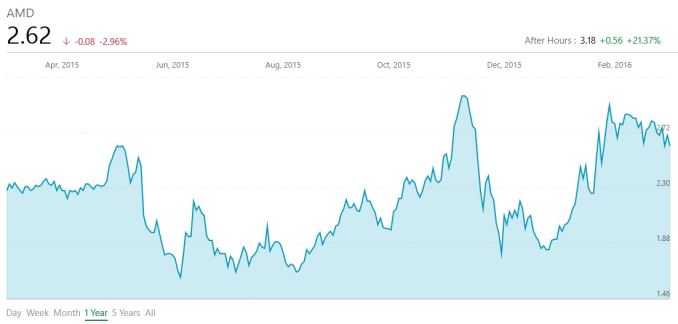

AMD announced their first quarter results from fiscal year 2016. AMD has certainly been struggling of late, but CEO Lisa Su made the announcement that AMD had made a joint-venture with THATIC for x86 processor development for the Chinese market. AMD will receive $52 million immediately and the total agreement is for $293 million, plus future royalties. This is a significant agreement for AMD, and licensing their IP is one of the ways they hope to get back to profitability.

Looking at the overall quarter, AMD had revenues of $832 million, which is down a significant 19% from last year. But the good news for AMD is that their gross margin is up to 32%, an increase over last quarter and having it come back to the same level as a year ago. AMD reported an operating loss of $68 million for the quarter, which is an improvement over the $137 million loss last year. The net loss for the quarter was $109 million, or $0.14 per share, which is once again an improvement over last year’s $180 million loss, or $0.23 per share.

| AMD Q1 2016 Financial Results (GAAP) | |||||

| Q1'2016 | Q4'2015 | Q1'2015 | |||

| Revenue | $832M | $958M | $1030M | ||

| Gross Margin | 32% | 30% | 32% | ||

| Operating Income | -$68M | -$49M | -$137M | ||

| Net Income | -$109M | -$102M | -$180M | ||

| Earnings Per Share | -$0.14 | -$0.13 | -$0.23 | ||

AMD also reports non-GAAP results, which exclude restructuring costs and stock-based compensation. On a non-GAAP basis, AMD had an operating loss of $55 million, compared to a $30 million loss last year where they had high restructuring charges. Gross margin came in at the same 32%, and there was a net loss of $96 million, or $0.12 per share, compared to a net loss of $73 million, or $0.09 per share last year.

| AMD Q1 2016 Financial Results (Non-GAAP) | |||||

| Q1'2016 | Q4'2015 | Q1'2015 | |||

| Revenue | $832M | $958M | $1030M | ||

| Gross Margin | 32% | 30% | 32% | ||

| Operating Income | -$55M | -$39M | -$30M | ||

| Net Income | -$96M | -$79M | -$73M | ||

| Earnings Per Share | -$0.12 | -$0.10 | -$0.09 | ||

The Computing and Graphics segment is still the largest part of AMD, and for this quarter they had revenue of $460 million. That is a drop sequentially of 2%, and a year-over-year drop of 14%, but AMD improved their operating loss for this segment, with a loss of $70 million for the quarter. This is an improvement over the $99 million loss last quarter, and an improvement over the $75 million loss a year ago. The revenue drop from last quarter was attributed to a drop in desktop processor sales, and the annual drop is due to a decline in notebook processor sales. Lowered operating expenses were the reason for the better operating loss levels, but both desktop and notebook processors are seeing a decrease in average selling price for AMD. GPU sales also dropped average selling price compared to last quarter, but increase year-over-year with higher channel and professional GPU prices.

| AMD Q1 2016 Computing and Graphics | |||||

| Q1'2016 | Q4'2015 | Q1'2015 | |||

| Revenue | $460M | $470M | $532M | ||

| Operating Income | -$70M | -$99M | -$75M | ||

The Enterprise, Embedded, and Semi-Custom segment had revenue of $372 million for the first quarter of this year, which is down 24% from last quarter and 25% from last year. This group is profitable though, although just slightly this quarter, with an operating income of $16 million for the quarter. This compares to a $45 million income in Q1 2015 though, which is a big drop when AMD’s already cutting it pretty close. AMD attributes the revenue drop to lower sales of semi-custom SoCs, of which a big market is consoles. It makes sense that as the consoles mature, sales will trail off, but AMD did well to get inside both the PlayStation 4 and Xbox One on this round of consoles, since both have been selling well compared to the previous generation. The decrease in operating income due to lower sales and higher R&D spending, but was offset by a $7 million IP licensing deal.

| AMD Q4 2015 Enterprise, Embedded, and Semi-Custom | |||||

| Q1'2016 | Q4'2015 | Q1'2015 | |||

| Revenue | $372M | $488M | $498M | ||

| Operating Income | $16M | $59M | $45M | ||

The All Other category had an operating loss of $14 million for the quarter, compared to a $107 million loss last year. That is because AMD had some large restructuring charges on the books last year.

Unsurprisingly, AMD is still sorting out their future, and their results reflect that. They have had a pretty large processing disadvantage compared to Intel for a long time now, and later this year they will finally start shipping on 14 nm nodes, but it is the deals for IP licensing which bring in constant revenue without the associated costs of revenue which are the big news this quarter. With rumours of updated consoles, they may also get a bump in their semi-custom SoC if and when that happens. Looking to next quarter, AMD is expecting revenues to come in 15% higher, plus or minus 3%.

Source: AMD Investor Relations

21 Comments

View All Comments

nikon133 - Tuesday, April 26, 2016 - link

Well... new PS4+ doesn't look bad, if rumors are true. GPU power is about doubled, 36 vs. 18 compute units and 10 - 15% faster clock. I've read somewhere that GPU is based on R9 2900. For a console that is not aiming to compete with high-end gaming PCs, that's quite decent. I think boost will be very handy for PlaystationVR gear.CPU getting only mild boost, from 1.6GHz to 2.1GHz. No info on any other improvements. I was hoping for 2.5GHz or more, but OK.

25% faster RAM, 218GB/s vs 176GB/s. That's in line with CPU increase.

New BD player capable to play 4K Blurays.

No info on price, but I expect it to have original PS4 release price of US$399, with "old" PS4 dropping down...$299? More? Less?