Sales of Client CPUs Soared in Q4 2023: Jon Peddie Research

by Anton Shilov on February 6, 2024 8:30 AM EST- Posted in

- CPUs

- AMD

- Intel

- Jon Peddie Research

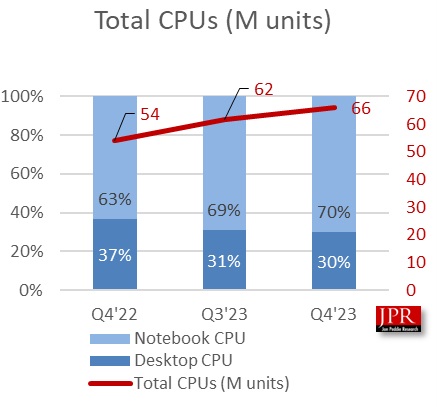

Global client PC CPU shipments hit 66 million units in the fourth quarter of 2024, up both sequentially and year-over-year, a notable upturn in the PC processor market, according to the latest report from Jon Peddie Research. The data indicates that PC makers have depleted their CPU stocks and returned to purchases of processors from Intel during the quarter. This might also highlight that PC makers now have an optimistic business outlook.

AMD, Intel, and other suppliers shipped 66 million processors for client PCs during the fourth quarter of 2023, a 7% increase from the previous quarter (62 million) and a 22% rise from the year before (54 million). Despite a challenging global environment, the CPU market is showing signs of robust health.

70% of client PC CPUs sold in Q4 2023 were aimed at notebooks, which is up significantly from 63% represented by laptop CPUs in Q4 2022. Indeed, notebook PCs have been outselling desktop computers for years, so, unsurprisingly, the industry shipped more laptop-bound processors than desktop-bound CPUs. What is perhaps surprising is that the share of desktop CPUs in Q4 2022 shipments was 37%.

"Q4's increase in client CPU shipments from last quarter is positive news in what has been depressing news in general," said Jon Peddie, president of JPR. "The increase in upsetting news in the Middle East, combined with the ongoing war in Ukraine, the trade war with China, and the layoffs at many organizations, has been a torrent of bad news despite decreased inflation and increased GDP in the U.S. CPU shipments are showing continued gains and are a leading indicator."

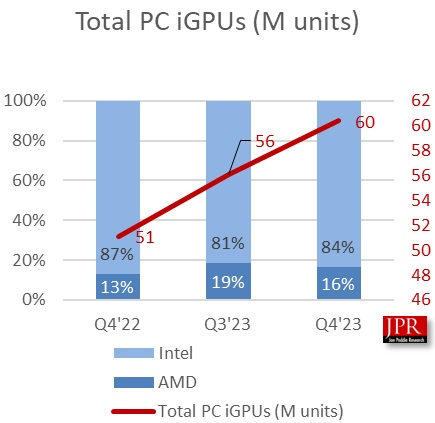

Meanwhile, integrated graphics processors (iGPUs) also grew, with shipments reaching 60 million units, up by 7% quarter-to-quarter and 18% year-over-year. Because the majority of client CPUs now feature a built-in GPU in one form or another, it is reasonable to expect shipments of iGPUs to grow along with shipments of client CPUs.

Jon Peddie Research predicts that iGPUs will dominate the PC segment, with their penetration expected to skyrocket to 98% within the next five years. This forecast may point to a future where integrated graphics become ubiquitous, though we would not expect discrete graphics cards to be extinct.

Meanwhile, the server CPU segment painted a different picture in Q4 2023, with a modest 2.8% growth from the previous quarter but a significant 26% decline year-over-year, according to JPR.

Despite these challenges, the overall positive momentum in the CPU market, as reported by Jon Peddie Research, suggests a sector that is adapting and thriving even amidst economic and geopolitical uncertainties.

Source: Jon Peddie Research

15 Comments

View All Comments

ballsystemlord - Tuesday, February 6, 2024 - link

@Anton , We haven't gotten to 4th quarter this year yet. You mean 2023."Global client PC CPU shipments hit 66 million units in the fourth quarter of 2024, ..."

Bruzzone - Wednesday, February 7, 2024 - link

Comparing 2023 JPR and Camp Marketing Annual AMD + Intel desktop and laptop PC unit volume.My general observation is that JPR estimates have been running low. JPR's q1 through q4 2023 desktop dGPU on noting JPR's q4 upward correction and now also encompassing JPR CPU 2023.

I've observed a concerted effort by industry and certain financial analysts to under report how well 2023 actually was in terms of total PC sales and in particular AMD graphics sales albeit at a cost.

Analyst total x86 comparison subject 'net' based volume estimate.

Mike the monitor always estimates on a 'net basis'. Analyst has disqualified gross method for determining x86 production volume negating that conceals infra marginal units of production.

JPR desktop and mobile;

JPR q1 = 47 M

JPR q2 = 54 M

JPR q3 = 62 M

JPR q4 = 66 M

All up = 229 M

CM desktop and mobile on Intel gross + AMD on net not including AMD q1 PS5/Xbox/Value which adds 15 M units.

Some would say this is Apples and Oranges but I wanted to show proximate to JPR and I was not going back to the spreadsheets to calculate AMD on gross as I have disqualified the gross method of evaluation. Why? It does not cover all costs albeit can also be costly when abused to control who owns surplus production values.

CM q1 = 50,255,897

CM q2 = 56,775,499

CM q3 = 55,784,852

CM q4 = 57,613,826

All up = 220,409,874

CM desktop and mobile on Intel net + AMD on net not including AMD q1 PS5/Xbox/Value which adds 15 M units;

CM q1 = 85,417,364

CM q2 = 78,387,305

CM q3 = 80,321,303

CM q4 = 78,177,616

All up = 322,303,678 this is the one!

Adding Xeon and Epyc on Intel gross and AMD always net this is Apples and Oranges again;

CM q1 = 58,472,389

CM q2 = 64,690,938

CM q3 = 62,361,701

CM q4 = 62,981,542

All up = 248,506,569

AMD = 25.9%

Intel = 74.1%

Adding Xeon and Epyc on Intel net and AMD always net this is the one!

CM q1 = 99,910,345

CM q2 = 92,623,263

CM q3 = 90,393,191

CM q4 = 90,712,121

All up = 373,638,921

AMD = 17.22% and plus 15 M q1 console = 20.42%

Intel = 82.78% and including AMD console = 79.58%

Now what about dGPU?

I record no dGPU for Intel in 2023 there is so little it's immaterial and priced at cost. I record 20,574,804 dGPU for AMD in 2023 of which 92% is fabricated in 2022 and supplied into the production chain. RDNA lll also appears for mid and bottom shelf SKUs to be priced at cost.

My AMD total for the year includes q1 console at 104,053,115 and I can show up to 109 M. Leaves Intel at 290,093,610 units and approximately 73.6% production share however this negates some contract volume. AMD then up to 26.3% production share.

Subject contract and extraneous volume Intel scores up to $316 M units of production and with other that x86 up to 374 M units in 2023.

Noteworthy when this or that analyst gives their annual x86 volume that is what Intel produces because it's always been Intel's monopoly to lose. Intel does not acknowledge AMD's existence pursuant the annual production 'volume' plan.

The point is x86 production volumes including server and workstation are much higher than commercial analysts portray. The reason is inframarginal units end up as sales close, thrown into procurement bundles, and may not be reported as revenue units. This is the financial fact being concealed.

Mike Bruzzone, Camp Marketing

Bruzzone - Wednesday, February 7, 2024 - link

Oh and my desktop : notebook split is close to JPR although at a much higher total volume as detailed above.Between desktop and mobile it's a 35.6% and 64.4% split respectively. Including Xeon and Epyc at 13.2%, my split is desktop is 30.9% and notebook 55.8%.

mb

PeachNCream - Thursday, February 8, 2024 - link

Its interesting and entirely unsurprising to see the continued decline of desktop CPU sales. There really are very few left on the market today that are in the consumer space. I would wager a healthy portion of that percentage are destined for business usage with low single digit percentages going direct to consumers as parts and very few of them are halo products that nerds use as toys for video games. The world has most certainly moved on from the box-o-fans style computer of twenty plus years ago.emvonline - Wednesday, February 21, 2024 - link

So 62 to 66...in a Q4... is "soared"?IGPUs are 90% of CPU shipments.... like for the past year or more... correct? or am I misreading the numbers